Branch Banking Gives Way to Customer-Focused Digital Services

The emergence of fintech and neo-banks has increased the level of innovation across the financial services industry. Branch banking is giving way to digital contactless banking services. The advantage of location is displaced by the ability to offer the products customers want with the service assurance they expect.

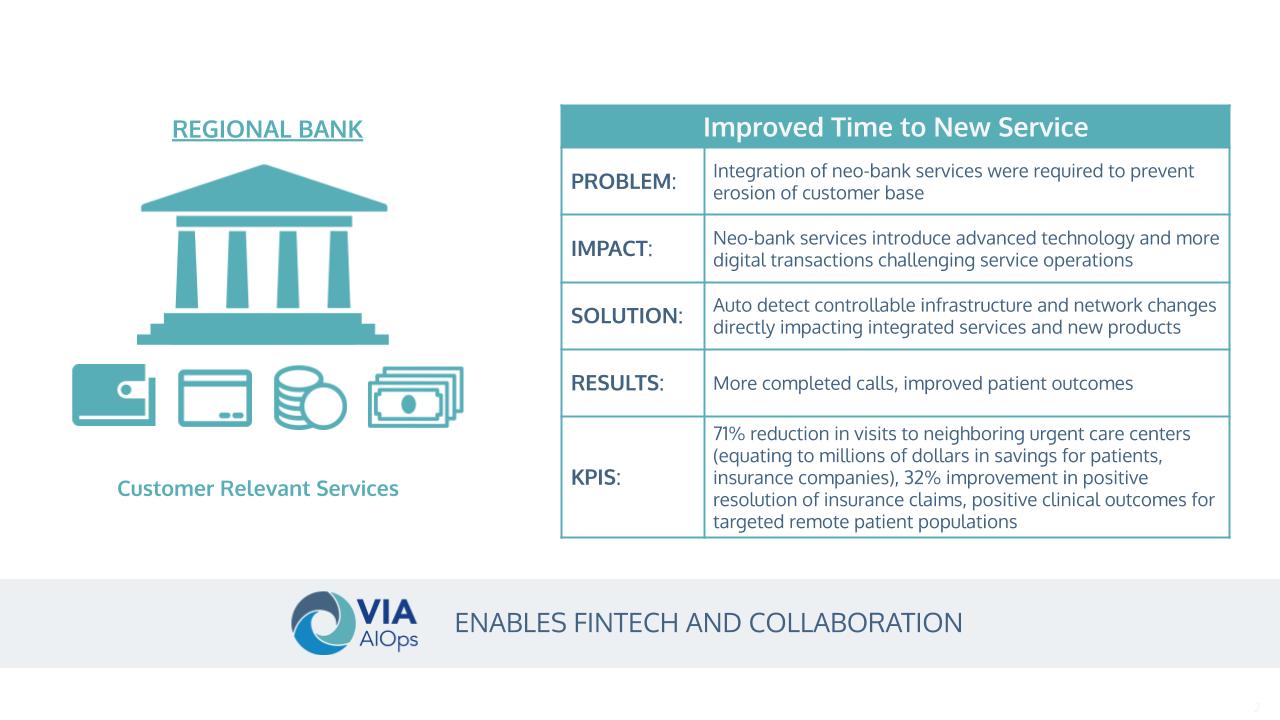

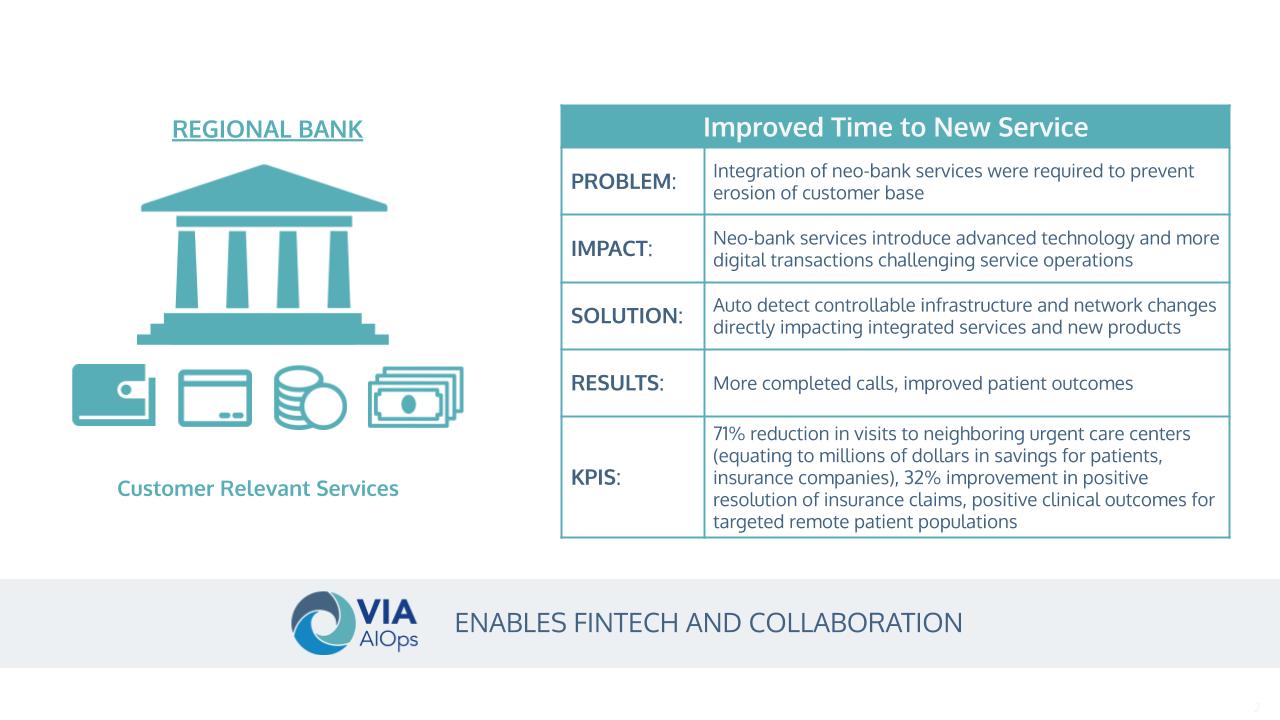

Progressive branch banking is transforming faster by partnering with neo-banks. Neo-banks fill the gaps in aging product portfolios. Neo-banks embrace fintech, often based on advanced technology. This new collaboration increases the service portfolio at a lower cost but the integration can also increase the complexity of service delivery.

Success in this new world is spelled SERVICE. AIOps enables Operations to up-level their service commitment to customers.

CHALLENGE: Seamless Integration of Neo-Bank Services Into the Product Portfolio

Banks are replacing high touch interactions at branch locations with machine assisted transactions and contactless mobile services. Customer populations are changing and so are their interests in bank services. Collaborating with neo-banks provides a fast way to deliver a menu of services and products aligned to the changing markets.

To enable growth, IT needs to examine Operations and choose technology to improve service delivery without inflating costs. IT Operations is a critical function for banks intent on competing in new markets. Their customers are on the move and expect their bank to be open and available when they need them.

Service Operations needs to support the business strategy with a service-centric delivery model:

- Reduce the time required to approve credit – eliminate system wait times

- Provide the convenience of transferring money between accounts to avoid credit delinquency and insufficient funds fees

- Provide digital wallets to help customers invest and save

- Lower the cost per account to return value to shareholders

What’s the model for ensuring the customer service experience?

- Gain visibility and discover dependencies within and between systems leveraging AI and machine learning

- Detect issues and service anomalies fast before they impact service performance and result in unnecessary operational cost

- Prevent service interruptions resulting from change

How a Regional Bank Used VIA AIOps to Enable New Services